How To Setup Charitable Foundation In Singapore?

In Singapore, non-profit organizations can operate as Companies Limited by Guarantee (CLGs), charitable trusts, or societies. Setting up a CLG offers several benefits, such as limited liability for members, no need for share capital, and eligibility for tax exemptions. This article explains the main features of a CLG and the steps to incorporate one.

What is a Company Limited by Guarantee?

A Company Limited by Guarantee (CLG) is a type of company often set up for non-profit activities or work that benefits the public, like charitable projects. Registered with the Accounting and Corporate Regulatory Authority (ACRA) and regulated by the Companies Act, CLGs give non-profit organizations a formal corporate structure. Additionally, CLGs can apply for charity status if they meet certain requirements.

What's the Difference Between Companies Limited by Guarantee and Companies Limited by Shares?

Companies Limited by Guarantee (CLGs) are different from companies limited by shares in a few key ways. CLGs don’t have share capital, so members’ liability is only up to the amount they agree to contribute if the company winds up, as stated in the company’s constitution. In contrast, for companies limited by shares, shareholders’ liability is limited to the value of the shares they own.

Why Should You Incorporate a Company Limited by Guarantee?

Some organizations may choose not to incorporate to save on costs, but incorporation provides valuable benefits.

First, incorporation offers members limited liability. When a CLG is incorporated, it becomes a separate legal entity from its members. This means that the CLG can sue or be sued in its own name, and its members are not personally responsible for the company’s debts—protecting their personal assets if the company faces financial trouble.

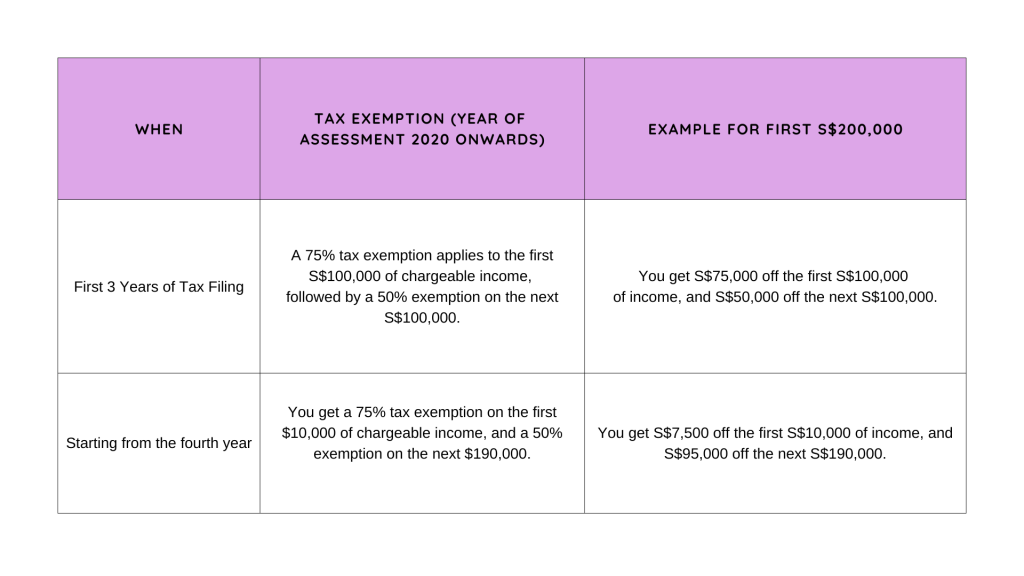

Incorporation can also bring tax advantages. While CLGs generally pay corporate tax at a rate of 17%, they may qualify for certain tax exemptions or deductions. Additionally, CLGs with charity status are exempt from tax.

Choosing the Right Legal Structure for Your Non-Profit: CLG, Society, or Charitable Trust

Non-profits in Singapore can operate as Companies Limited by Guarantee (CLGs), societies, or charitable trusts. Each structure has distinct characteristics, so it’s important to understand their differences to choose the best fit for your organization.

- Structure Differences

A society requires at least 10 members and is best for small, membership- or volunteer-based groups. A trust is typically created by individuals who want to set aside funds for charitable purposes, but it can be expensive to establish and maintain. - Legal Identity and Liability

Unlike CLGs, societies and trusts do not have separate legal identities. This means societies and trusts cannot sue or be sued as entities; instead, individual members or trustees bear personal liability for any legal issues or debts. By contrast, a CLG has its own legal identity, allowing it to sue or be sued in its own name. Members of a CLG enjoy limited liability, which protects their personal assets from company debts or losses. Considering these factors, CLGs offer the advantages of legal protection and tax benefits, making them suitable for many non-profits.

Steps to Incorporate a Company Limited by Guarantee in Singapore

- Legal requirements

To set up a Company Limited by Guarantee (CLG) in Singapore, you need to apply through ACRA. The company’s constitution must be submitted on ACRA's BizFile+ website. The constitution should include the company's name, the amount each member guarantees to pay if the company is wound up, and a clear statement of the company’s objectives. - Procedure, Documents, and Fees

Reserving the company name costs $15, and the registration fee for a CLG is $300. Once the registration fee is paid, the company is usually incorporated within 15 minutes. If the application requires further review by authorities, it may take between 14 days and 2 months for approval.

Regulatory Compliance for Companies Limited by Guarantee

CLGs might need to apply for specific licenses, depending on their activities. This should be done when registering with ACRA. To check and apply for the required licenses, visit the GoBusiness website.

How Much Are Companies Limited by Guarantee Subject to Tax, and Do They Qualify for Tax Deductions or Exemptions?

CLGs can qualify for corporate tax deductions and exemptions, but how much of their income is taxed depends on the type of income they earn.

If a CLG:

- Operates as a trade or professional association, and

- Earns more than 50% of its revenue from membership fees from Singapore members, which are tax-deductible under section 14 of the Income Tax Act,

then the CLG is considered to be running a business. This means all income from both Singapore members and non-members is taxable. However, if 50% or less of the revenue from Singapore members is tax-deductible, only the income from non-member transactions is taxable.

How to Apply for Charity Status for a Company Limited by Guarantee

A Company Limited by Guarantee (CLG) may want to apply for charity status because it allows them to get full tax exemption on their income.

To apply for charity status, a CLG must meet the criteria set by the Commissioner of Charities. Charities can run business activities, but these activities must be limited.

In Singapore, a charity is an organization that:

- Operates on a not-for-profit basis;

- Is set up for charitable purposes only; and

- Carries out activities that benefit the public.

Charitable purposes include:

- Helping the poor;

- Promoting education;

- Advancing religion; or

- Other community-benefiting purposes, such as improving health or animal welfare.

To apply for charity status, the organization must submit an application within 3 months of being set up through the Charities Portal. The organization must show the Commissioner of Charities that:

- Its goals are purely charitable;

- It has at least 3 board members, with at least 2 being Singapore citizens or permanent residents;

- Its goals mostly benefit the Singapore community.

Dissolving a Company Limited by Guarantee (CLG)

A CLG can be dissolved in different ways, such as winding up or striking off.

Winding Up happens when the company cannot pay its debts. The company is shut down, and any money from selling its assets is used to pay the creditors. Winding up can happen in two ways: either involuntary (forced by the court) or voluntary (chosen by the company).

Striking Off is another way to dissolve a CLG. A director can ask ACRA to remove the company’s name from the official register, usually when the business has closed or the CLG has already been fully wound up.

What Happens to a CLG’s Remaining Funds/Assets? Can They Be Given to Members?

Any remaining funds or assets of the CLG after it is wound up cannot be given to its members. Instead, they must be given to organizations with similar goals or to a registered charity, as decided by the Commissioner of Charities.

Professional Help to Setup Charitable Foundation In Singapore

If you want to start a non-profit organization in Singapore, it's a good idea to get professional help. A services provider can guide you through the registration process and ensure you meet ongoing compliance requirements.

Clooud Consulting specializes in helping people set up non-profit organizations and foundations for various charitable goals. Whether your focus is on humanitarian work, conservation, supporting underprivileged families, or environmental issues, we have the expertise to assist you. Are you curious to know more? Reach out to us for a quote!