Transforming HR and Payroll with Employement Hero

In today’s fast-changing business world, flexibility and innovation are key to success and growth. Employment Hero is leading this change, offering complete HR and payroll solutions designed specifically for Southeast Asian businesses. As the Head of Sales & Partnerships for Southeast Asia at Employment Hero, I’m excited to share how our initiatives are set to transform HR and payroll in the region.

Supporting SMEs through the PSG Grant

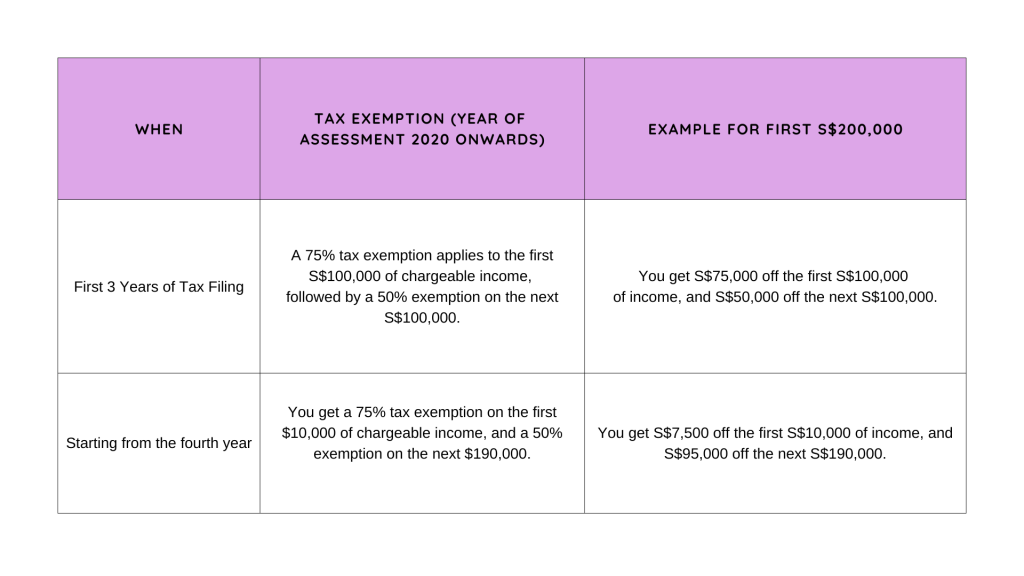

Small and medium-sized enterprises (SMEs) are essential to our economy and play a vital role in Southeast Asia's growth. To support these businesses, governments in the region have introduced initiatives like the Productivity Solutions Grant (PSG) in Singapore. This grant helps businesses improve productivity by adopting new technologies.

The PSG grant offers financial aid and encourages SMEs to go digital, which is crucial for staying competitive in today’s fast-paced world.

Employment Hero is proud to be an approved vendor for the PSG. This means we are dedicated to providing advanced solutions that make HR processes smoother, improve efficiency, and boost productivity. Our platform helps SMEs manage HR tasks like recruitment, onboarding, payroll, and compliance more effectively. By automating routine tasks, we allow business owners and HR teams to concentrate on strategies that promote growth.

As a PSG-approved vendor, companies can receive up to 50% off through the Productivity Solutions Grant (PSG) to help them adopt Employment Hero’s platform, which is a comprehensive solution for ambitious businesses.

With the PSG grant, SMEs can save up to 50% on their HR and payroll costs. This significant savings allows business owners to invest more in their growth without worrying about their budget.

Future with Employment Hero

The future of work is all about flexibility. The COVID-19 pandemic has sped up the move toward Flexible Work Arrangements (FWA), showing how important it is to adapt in the workplace. At Employment Hero, we think flexibility is essential for attracting and keeping top talent in today’s competitive job market.

In Singapore, new FWA guidelines are set to take effect on December 1, 2024. These guidelines include options like flexi-time and flexi-place and require employers to consider employees’ requests for flexible arrangements fairly. This promotes a more supportive and adaptable work environment.

Employment Hero’s flexible work approach is based on three main ideas: Location Flexibility, Time Flexibility, and Role Flexibility.

Location Flexibility:

Employees can work from wherever they feel most productive, whether it's home, a co-working space, or another city. This flexibility helps companies attract a wider range of talent and boosts employee satisfaction. For example, 82% of our Singapore team has said that less commuting time and stress positively affect their personal lives.

Time Flexibility:

Employees can choose their working hours to better fit their personal lives and when they are most productive. This flexibility helps reduce stress and burnout, leading to higher productivity and job satisfaction. In fact, 68% of our Singapore team has reported better mental well-being and focus with flexible working hours.

Role Flexibility:

This encourages a more adaptable approach to job roles and responsibilities. It can include job sharing, part-time positions, or the chance to switch between different projects based on skills and interests. This kind of flexibility can boost employee engagement and help with career development.

Flexible Work Arrangements (FWAs) benefit both employees and employers. For employees, FWAs improve work-life balance, cut down on commute times, and boost job satisfaction. For employers, FWAs can lead to increased productivity, reduced absenteeism, and better employee retention, helping to develop local talent in Singapore.

Employment Hero strongly supports FWAs and offers tools to help businesses implement them successfully. Our platform allows companies to easily manage remote work, flexible hours, and other FWA options. Encouraging a flexible work culture, we help businesses build a more adaptable and resilient workforce ready for the future.

Complete HR and Payroll Solutions Suite

Managing HR and payroll can be challenging, especially for businesses operating across Southeast Asia with diverse regulations. That’s where Employment Hero’s all-in-one HR and payroll platform comes in, perfectly designed to meet the unique needs of businesses in the region. From recruitment and onboarding to payroll and compliance, Employment Hero simplifies the entire process.

One of the standout benefits of this platform is its ability to automate routine HR tasks. By partnering with Clooud Consulting, you can leverage this automation to save time and reduce errors, allowing your HR team to focus on what truly matters—employee engagement, talent development, and strategic planning.

Compliance is another area where Employment Hero shines. The platform helps ensure that your business adheres to local labor laws and regulations, minimizing the risk of legal issues and fines. With Clooud Consulting by your side, you can stay updated on the latest regulatory changes, giving you peace of mind to concentrate on growth and innovation.

Partner with Cloud Consulting and Employment Hero for Your Business Success!

At Clooud Consulting, we are proud to partner with Employment Hero, a leader in innovative HR and payroll solutions tailored for businesses in Southeast Asia. Our collaboration simplifies HR management, helping you stay competitive in today’s dynamic market.

Embrace change and leverage technology to fuel your growth. With initiatives like the PSG grant, we support SMEs on their digital transformation journeys. Promote flexible work arrangements to cultivate a more adaptable and resilient workforce. Plus, with Employment Hero’s SmartMatch feature, finding and hiring the right talent has never been easier.

For more information on how Clooud Consulting and Employment Hero can elevate your business, contact us today!